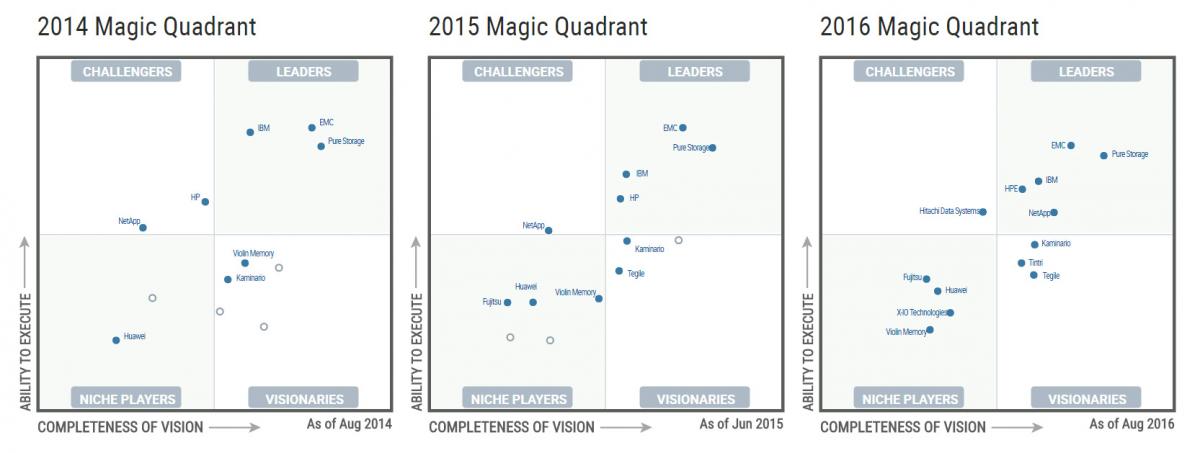

Magic Quadrant for Solid-State Arrays

Solid-state arrays have moved the external controller-based storage array market from a relatively stagnant incrementally improving market with slow-changing dynamics to a progressive neoclassical market. By 2020, SSA purchases by revenue will be approximately 50% of the external controller-based storage array market. We also expect that by 2020 the SSA market will reach $9.67 billion, up from a market size of $2.7 billion in 2015. While the overall SSA market is growing, it is very dynamic and we continue to expect some vendor churn; so that, by 2018, the total number of SSA vendors will increase by 50%, but 20% of the current SSA vendors will exit the market.

Solid-state arrays have moved the external controller-based storage array market from a relatively stagnant incrementally improving market with slow-changing dynamics to a progressive neoclassical market. By 2020, SSA purchases by revenue will be approximately 50% of the external controller-based storage array market. We also expect that by 2020 the SSA market will reach $9.67 billion, up from a market size of $2.7 billion in 2015. While the overall SSA market is growing, it is very dynamic and we continue to expect some vendor churn; so that, by 2018, the total number of SSA vendors will increase by 50%, but 20% of the current SSA vendors will exit the market.

Improvements in the dynamics of many factors — such as reduced storage administration, power, cooling, rack space, increased performance and density — have changed the accepted assumptions of the previous SAN storage array market. More vendors design and develop their own custom solid-state solutions, such as Hitachi Data Systems, Huawei, IBM and Violin Memory. In 2016, this was shown with the DSSD offering from EMC and FlashBlade from Pure Storage. Consequently, more vendors are offering alternate solid-state media form factors with denser and faster systems when they create their own NAND flash storage packaging. From a whole system perspective, the largest SSAs now scale to 3.9PB, and next-generation SSD technology (such as Intel 3D XPoint) and interconnects (such as nonvolatile memory express [NVMe] PCIe SSD) will again redefine performance capabilities, creating demand for faster storage networks (see "The Future of Storage Protocols" ).

Neither the solid-state array, nor the storage array administrator is the bottleneck anymore; but network latency has become the challenge. This has extended the requirement and life span for 16 Gbps and 32 Gbps Fibre Channel SANs, as Ethernet-based networks and related storage protocols struggle to keep up. Many new vendors have entered the market, such as Pivot3 who provide comprehensive service management via QoS and Nimble Storage with the highly scalable AF Series, and along with many traditional storage vendors, they continue to transition their portfolios from HDD-based arrays to all solid-state arrays.

Consolidation is also taking place, with Dell acquiring EMC, Pivot3 acquiring Nexgen and NetApp acquiring SolidFire, as well as Cisco officially discontinuing its SSA offering inherited from its Whiptail acquisition. Companies are also resizing, for example, HP splitting its consumer and enterprise businesses and X-IO realigning its business units. The market is growing with fierce price competition as incumbent storage vendors offer existing accounts very favorable terms when moving to SSAs. Solid-state arrays have reduced in price, with effective storage guarantees from some vendors reaching the $1 per GB level, over a three year period. Upgrades, as well as effective capacity upgrades, are common offers and promises; however, many guarantee programs cannot keep the same trays and controllers, and require forklift upgrades, which negate the value of the promised upgrade guarantee programs. Customers therefore need to check for disruptive forklift upgrades. Because many hybrid and HDD general-purpose arrays have low capacity utilization, SSAs — which are not performance-bound — can be used at higher utilization rates. Therefore, an SSA that is two to three times more expensive to purchase becomes a cost-effective replacement for a hybrid or general-purpose array at increased utilization rates. With regard to performance, one SSD can typically replace multiple HDDs, combined with data reduction features and increased storage administrator productivity the price point at which SSA investment decisions are made is dropping rapidly. Redundant array of independent disks (RAID) rebuild times for high-capacity SSDs are also faster than for high-capacity HDDs. Therefore, as HDD storage capacities increase, so do HDD recovery times, and SSAs reduce the risk exposure during any media failure and recovery window. Use cases for SSAs are moving into analytics, file and object workloads, and some customers even use SSAs as backup targets to reduce backup and restore windows.

Price and ownership programs translate into very competitive purchase prices for buyers, but vendors are faced with challenges to becoming profitable as incumbent vendors discount to avoid losing market share and new vendors discount to attract new customers. Because the SSA market has expanded rapidly with SSD reliability being equal to or better than HDD arrays, and feature parity also equalizing, the competitive battle to differentiate has moved to ease of ownership, and remote and pre-emptive support capabilities.